You have just arrived in Japan with your new visa, and you are looking for information about opening a bank account. Don’t know which bank to go to or what documents to get? No need to look any further. You are at the right place! As an expatriate in Japan for three years, I also had to go through this process when I settled in Kyoto. So here are some recommendations and tips and tricks to open your very first bank account in Japan to start your new life in the land of the rising sun!

Before we begin, a few notes: This article deals only with ordinary bank accounts (futsu yokin, 普通預金) as opposed to a credit union. Opening a bank account in Japan requires a long-term visa. This is not possible with a tourist visa.

- Which Banks Are the Most Friendly to Foreigners in Japan?

- How to Open a Bank Account in Japan

- Tips and Tricks to Opening Your Bank Account in Japan

- Is It Possible to Get a Credit Card in Japan?

Which Banks Are the Most Friendly to Foreigners in Japan?

Depending on the region, there are many banks in Japan, and it would be impossible for me to mention them all here. So I will only tell you about the banks recommended to me by other foreigners or that I am using myself.

There are two options: traditional banks with physical counters and face-to-face meetings with the staff, or online banks if you prefer to manage your accounts from your living room.

The Best Traditional Banks in Japan for Foreigners

If you prefer face-to-face contact and if online chat gives you nightmares, the following banks have a reputation for being gaijin-friendly in Japan:

Japan Post Bank (ゆうちょ銀行, Yucho Ginko)

The most famous and flexible bank in Japan is known as Japan Post Bank. As well known among Japanese as among foreigners, its clientele represents 78.3% of the inhabitants of Japan, that is to say, a rate of use highly superior compared to other banks. This bank has a significant advantage over its competitors.

It requires few documents and does not require regular income, unlike other banks. When you arrive in Japan as a foreigner, you don’t necessarily have a fixed apartment or job from the start. So Japan Post Bank is an ideal option for those starting in Japan. Many of my foreign colleagues chose this bank as soon as they arrived because it was the easiest solution.

| Benefits of Japan Post Bank |

| Requires little required documents for registration |

| No regular income is required, you just need to deposit a minimum of 1,000 yen when you open your account. |

| This bank is the most widely used bank in Japan and compatible ATMs can be found everywhere in the country. |

| Disadvantages of Japan Post Bank |

| Information on the registration process is available in several languages (including English) but once registered, the interface is only available in Japanese. |

| It is difficult to obtain a credit card through this bank for foreign customers. |

I had also heard about this bank when I arrived, but since its services are not English, I opted for another bank. If you are not afraid of Japanese and don’t need a credit card, this could be an option to consider.

Shinsei Bank (新生銀行)

Even though I speak Japanese, administrative procedures in Japanese terrified me at the time (and still do today). So I was looking for a bank with services in English, to make sure I understood everything.

Before going to Japan, I searched on the internet the different Japanese banks known to be gaijin-friendly, and I quickly came across several messages recommending Shinsei Bank (新生銀行). This one is reputed to be THE foreign-friendly bank in Japan and offers all its services in English. That is why I chose it when I arrived in Japan.

| Benefits of Shinsei Bank |

| All services are available in English (online interfaces, telephone information, user manuals, etc.). |

| Compatible with most ATMs available in konbini (Japanese convenience stores). |

| Possibility of obtaining a credit card as soon as the account is opened. |

| The registration process can be done online. |

| Disadvantages of Shinsei Bank |

| Requires several documents to open an account (proof of address, resident card, telephone number, etc.). |

| If you do not have a regular income, you must have resided in Japan for at least 6 months to open a bank account. |

| 110 yen will be charged for each ATM withdrawal. |

The Shinsei Bank has more disadvantages than the Japan Post Bank. Still, it fulfills two fundamental conditions for me: services in English and the possibility to apply for a credit card more easily (without any fees!). The most significant disadvantage is that you have to pay 110 yen for each withdrawal from an ATM, and it requires that you have lived in Japan for at least six months to apply. This condition does not concern people with a work visa, which was my case. Unfortunately, this was not the case for my husband, who arrived in Japan with a student visa. He had to wait six months before registering because he did not have a regular income.

Anyway, I am quite satisfied with the services of this bank three years later, and I enjoy my credit card! So if you are coming to Japan on a work visa and want a credit card and services in English, this is an option to consider.

The Best Online Banks in Japan for Foreigners

The advantage of an online bank is that there are no banking fees for remote services, unlike a traditional bank. If you don’t mind online procedures and want to be connected to your bank at any time, consider online banks, which are becoming more and more popular in Japan. Here are two online banks recommended by friends:

Seven Bank (セブン銀行)

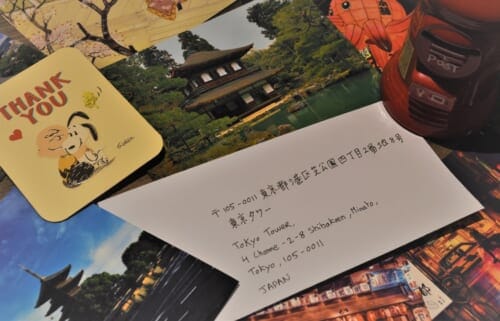

If you are familiar with Japanese konbini (convenience stores), then you have probably already heard of this bank. Seven Bank is very well known among foreigners for its multilingual services, but especially for its advantageous transfer fees available 24 hours a day. Sending money abroad is possible in more than 200 countries and will cost you less through this bank. The registration procedure is done online and by mail. Still, as not everyone speaks English or Japanese, the bank has opened small branches in several major cities in Japan (Kanagawa, Fukuoka, etc.) where it is possible to register directly with the help of English-speaking staff. This online bank sounds a little bit like a traditional bank, but only for registration. For any other step, it has to be done online.

| Benefits of Seven Bank |

| Online services are available 24 hours a day. |

| Low transfer fees in Japan and internationally. |

| All services are available in English (online interfaces, telephone information, user manuals, etc.). |

| No regular income is required, you just need to deposit a minimum of 1,000 yen when you open your account. |

| Withdrawal possible via an ATM present in any 7/11 convenience stores (more than 20,000 in Japan!) |

| Disadvantages of Seven Bank |

| Almost no face-to-face service, as everything is done online |

| It is difficult to obtain a credit card through this bank for foreign customers who do not have a regular income. |

| If you do not have a regular income, you must have resided in Japan for at least six months to open a bank account. |

To recap, a multilingual bank, online, accessible anytime from your living room, with very interesting transfer fees compared to other banks. If you want to send money abroad from your Japanese bank account, and if online contact is enough for you, this bank is for you!

Sony Bank (ソニー銀行)

Honestly, I’m not personally familiar with this bank, but it was Voyapon’s SEO Manager, Romeo, who recommended it to me! All procedures are done online via the bank’s multilingual app. Easy, convenient, and accessible anywhere!

It seems to be more advantageous than other banks, mainly because it offers a contactless credit card that can be used abroad, which is not the case for all banks. Far from it, in fact! Even though I have a VISA credit card, I can’t use it when I return to France, so I have to deal with payments by cash. Additionally, transfers from abroad are free via Sony Bank, and it is also possible to exchange some currencies without any fees, which is advantageous.

| Benefits of Sony Bank |

| Online services are available 24 hours a day. |

| Possibility of obtaining a contactless credit card from the opening of the account which is usable abroad. |

| Low transfer fees in Japan and internationally. |

| All services are available in English (online interfaces, telephone information, user manuals, etc.). |

| No regular income is required, you just need to deposit a minimum of 500 yen when you open your account. |

| Disadvantages of Sony Bank |

| If you do not have a regular income, you must have resided in Japan for at least six months to open a bank account. |

| Almost no face-to-face service, everything is done online |

| A limited number of free ATM withdrawals per month. |

Sony Bank seems to offer all services you would expect from a bank, accessible from the comfort of your living room. This one adopts a gaijin-friendly approach by offering international services accessible to all. Just connect through the app on your phone for all the procedures. The Japanese bank of the future!

How to Open a Bank Account in Japan

Now that you’ve chosen the bank you want to join, it’s time to find out how to register. Every bank is different, and it is best to check directly on their website. However, most banks follow a similar process.

What documents are required to open a bank account in Japan?

What documents are required to open a bank account in Japan? This is the question I will try to answer here. It depends on the bank, but here are some documents that could be necessary when you open your bank account.

- The most common required documents:

- Your residence card (zairyu kado, 在留カード) with your current address written on the card.

- Your name (namae, 名前) in katakana (remember to check how to write it, it will be necessary for any administrative procedure in Japan).

- Your personal seal (hanko, 判子 or inkan, 印鑑). Depending on the bank, this may be replaced by a simple signature.

- A phone number (denwa bango, 電話番号) in Japan (mostly overseas phone numbers are not accepted).

- A minimum deposit of 1,000 yen.

- Documents not commonly requested:

- A residence certificate juminhyo, (住民票) which you can get at the city hall.

- Your my number card (マイナンバーカード) which often reassures banks especially when applying for a credit card.

- A work certificate (zaishoku shomeisho, 在職証明書) from your company or a school certificate or student card (gakuseisho, 学生証) from your school or university to prove your current activity.

Don’t panic! If this list makes your head spin, keep in mind that the required documents depend on each bank. Some banks are satisfied with basic documents, while others seek to have as many guarantees as possible. Just like in any other country!

Administrative Procedures When Opening Your Japanese Bank Account

Once you have the required documents in your possession, go to the desired bank or start the process on the internet if you choose an online bank. You will need to fill out the necessary documents with your personal information (name, nationality, date of birth, etc.) and you will be asked to choose a 4-digit PIN code for your withdrawal card (cash card, キャッシュカード). How is this different from a credit card? A credit card allows you to pay for your purchases in a store or on the internet, while a withdrawal card, as its name suggests, only allows you to withdraw money from an ATM.

Depending on the bank, you may also receive a bankbook (tsucho, 通帳) allowing you to check your transactions or make bank transfers via an ATM. Personally, I never had one with Shinsei Bank, as I can check my activity online directly on my bank’s English website. If your bank provides you with one, keep it with you.

At the end of the registration process, you will be offered a few additional services, such as the possibility to open a savings account or to apply for a credit card. This is the perfect time to ask various questions about international transfers, account statements, and the list of compatible ATMs. Once all these steps are completed and your documents in hand, you have officially opened a bank account in Japan! Congratulations!

Tips and Tricks to Opening Your Bank Account in Japan

When I arrived in Japan, I was trapped in what I call “the endless loop.” That’s how I felt when I started all my administrative procedures in Japan. Let me explain: my bank asked me for my phone number in Japan to register, but to get one, most mobile operators ask for a bank account number and a credit card to proceed with the monthly deduction of the phone subscription. The different services pass the buck, and you have to know how to find your way out of this endless loop. Here are some tips and tricks to open your bank account in Japan:

- To get a phone number, I used my French credit card before opening my Japanese bank account. There are also prepaid SIM cards that give you a temporary phone number.

- Cheques are not used in Japan. So don’t bother asking when you register if it is possible to get a checkbook, they won’t understand what you are talking about.

- When you open your bank account, you will be asked about your involvement in criminal organizations. Don’t be surprised: this is a formality imposed by law and required of anyone who wishes to open a new bank account.

- In Japan, many traditional bank offices close at 3 PM (that is one of the reasons why online banks have an advantage). So if you choose a traditional bank, make sure you go there in the morning or early afternoon before closing time.

- If you change your address, period of stay, residence status, school, or workplace, you must inform your bank. If you do not, you may receive a letter asking you to regularize your situation as soon as possible, in which case your account may be suspended. The same applies, of course, if you lose your bankbook or your payment card.

- When leaving Japan, be sure to close your account before you go. Even if your account is empty, you are required to close it before leaving the country, as stipulated in most bank contracts. If you don’t, you may run into trouble with your bank, which could potentially charge you a fee.

Is It Possible to Get a Credit Card in Japan?

Although credit cards are used very frequently in the West, it is the opposite in Japan. Most of the time, we pay in cash, and many here in Japan do not have a credit card, with only a cash card to withdraw money from ATMs. However, a credit card is fast becoming more necessary as online shopping becomes more popular. I was able to get my credit card as soon as I opened my bank account because Shinsei Bank has a partnership with Gaica, a prepaid credit card service. This card is directly linked to my bank account from which I can transfer money and spend all my salary on the internet (which is a tragedy for my savings.)

This type of card is more prevalent in Japan and aimed at both foreign customers and Japanese ones. People are starting to play the game of credit cards, which are increasingly used nowadays in big stores. However, you should know that there is a bad reputation for not trusting foreigners without regular income concerning credit cards, especially with the language barrier. Therefore, it can be challenging to get one. Be sure to ask your bank if you can get a credit card when you open your bank account. The bank may have some partnerships and advantages that you can take advantage of.

Last but not least, if you are coming to Japan and you are only staying for a short time, you should know that some foreign credit cards can be used in Japan. There are foreign banks such as Revolut or N26 that can accept foreign currencies (including Japanese Yen) and allow the use of their credit card without fees abroad. Therefore, if you are only staying for a short time and want to get a credit card, it may not be necessary to open a bank account in Japan.

Opening a bank account and obtaining a credit card in Japan is like a new journey that may seem to be full of pitfalls at first glance, but remember that you are not alone and that many other people have gone through it before you (and made it!). The process varies a lot from bank to bank, and banks are changing over time, especially with the advent of online banks. Somewhere in Japan is the bank of your dreams, so don’t hesitate to take the first step and contact them to find out about their services. Your new bank account is waiting for you!

No Comments yet!